Analysts say the growth in government savings schemes is tepid because there has been a clear shift toward equities.

MUMBAI: Small savings options, which banks had blamed for poor monetary transmission, appear to be slowly but surely losing sheen as lower yields and a booming stock market wean away savers from the traditional interest-bearing instruments.

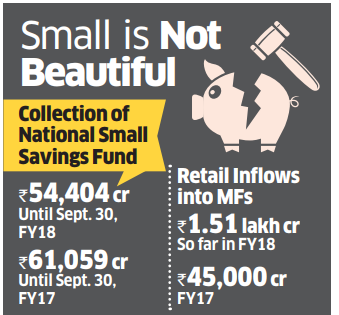

Until September 30 this fiscal, the National Small Savings Fund ( NSSF), an aggregate of savings through government plans such as post office, public provident fund (PPF) and kisan vikas patras, collected Rs 54,404 crore, down 11% from Rs 61,059 crore gathered in the same period last year.

Analysts say the growth in government savings schemes is tepid because there has been a clear shift toward equities.

“Also, last year there was a bonanza from the Seventh Pay Commission and interest rates in these schemes were also higher. That differential has now come down. The amount of inflows the equity markets are seeing every month is a testimony to the shift away from small savings,” said Saugata Bhattacharya, chief economist atAxis Bank.

Monthly inflows into mutual funds though the systematic investment plans alone have tripled in the last one-and-half years to Rs6,000 crore in October from Rs 2,000 crore in March 2015. So far in FY18, retail inflows into mutual funds increased to Rs 1.51 lakh crore from Rs 45,000 crore last year, with the benchmark stock index gaining 12.20%.

Meanwhile, the government reduced the PPF rate to below 8% for the first time in 40 years this fiscal. The current rate on the PPF scheme, the only tax-free small savings option now, stands at 7.8%.

If the trend continues, the collection in the NSSF will be lower than the budgeted Rs1lakh crore this year, which means the government may be forced to borrow more through bonds. To be sure, the jury is still out on the potential shortfall.

“There are still six months to go for the fiscal and it is likely that the small savings investments will pick up later in the year. I don’t think we can still say that the government will have to increase its borrowing this fiscal,” said A Prasanna, chief economist at ICICI Securities Primary Dealership.

Source : The Economic Times

0 comments:

Post a Comment