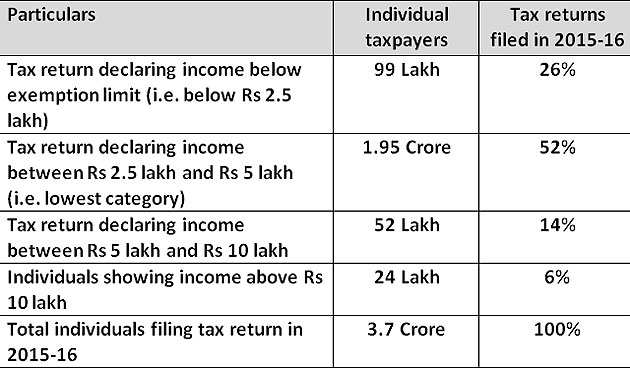

Indian society is generally tax non-compliant - quoted by the Finance Minister during his Budget 2017 speech. He also shared following interesting data relating to tax returns filed by the individuals, during the year 2015-16:

The more interesting aspect lies in subsequent observations. The FM quoted that, out of total 76 lakh individuals declaring income above Rs 5 lakh to Rs 10 lakh, 56 lakh individuals are from salaried class. Hence, it is no secret that for the FM, the individuals drawing salary is most tax contributing category in this class. However, the benefit of reduced tax rate slab from 10% to 5% is unlikely to have any major incremental impact on the take home salary package of individuals.

Further, the FM has proposed to recover the above tax foregone from the easiest target, i.e., honest taxpaying individuals falling in highest tax slab category. Instead, the welcome move could have been to attempt to bring in such people within tax bracket who do not pay tax at all despite of earning crores of agriculture income. Important to mention here is the fact that the agricultural income is exempt from tax which is earned by large population of India.

Plight of salaried class

The salaried class always struggled to own their own house and one ends up shelling out their large amount of salary towards interest payable on housing loan taken. The individuals owning one house property is anyway not given full benefit of interest paid which is restricted to Rs 2 lakh per annum.

Whereas if the individual owns one additional house, he gets full deduction of interest against the let out value of the house property. Meaning thereby, an individual who is better off and capable of owning two houses was given more benefit that the individual who is more needy and trying to make ends meet in some manner.

While the expectation was that, the full interest deduction (as currently available in case of let out properties) will be extended to such needy service class who own single house, the current budget proposal does completely reverse.

It is proposed by Finance Bill, 2017, to restrict the deduction on account of loss from house property (which is mostly due to interest on housing loan) to Rs 2 lakh and balance unabsorbed loss from house property to be carried forward for subsequent eight years to be set off. It is highly unlikely that such carry forward housing loss will be fully consumed, since the housing loan generally continues for more than 10 years to 15 years.

As if this was not enough, wait till you, understand below proposal.

Individuals are now expected to deduct tax at source @ 5% from rent paid above Rs 50,000 per month and undertake compliance requirement (though attempted to be simplified). Hence, if the landlord is not willing to such arrangement, it is likely that finding house for rentals will be difficult, further, it may lead to part payments being made in cash, which will further add on to parallel economy.

If the argument in favor of this proposal is to catch hold of the payees at source level, in this regard, an amendment to Rule 12BB of the Income-tax Rule, 1962 had already been introduced in the past where in the salaried class is required to report the PAN of landlord to their employer who in turn reports to the tax department in their withholding tax return.

The above proposals are likely to:

*Hit hard to the most tax compliant category, i.e., salary class;

*Add to the parallel black economy; and

*Hamper the housing sector hard.

Hope the plight of most meek class of taxpayer is heard at the highest level.

(By Nilesh Bhagat, Director, and Darshana Deshmukh, Deputy Manager, Deloitte Haskins and Sells LLP. Views expressed are personal.)

Source:-The Economic Times

0 comments:

Post a Comment