It's shocking but true only 1% of a billion plus Indians pay taxes.

The reasons are manifold - such as a huge parallel economy, which the government is trying hard to tackle or that agricultural income is tax free in an agrarian dominant society.Contrast this: Super rich farmers don't have to cough up a single paise as tax, while the salaried class bear its full brunt.

Unlike self-employed individuals (be it business persons or professionals), salaried employees only enjoy a few tax free allowances, the quantum of which has clearly not kept pace with inflation.

For instance, a small tax exemption of Rs. 1,600 per month is available for transport allowance paid for commuting to and fro between home and office. For a person residing in Virar (a suburb of Mumbai) who commutes daily to his office in the Nariman Point business district - a first class monthly season ticket plus auto fare from his home to the railway station works upwards of Rs. 2,500.

While tax free limits for allowances which can be availed of by salaried employees are fixed by the government, salaried employees face another hurdle when it comes to reimbursement of claims.Most companies impose caps for reimbursement of expenses. Or some expenses, such as training for selfdevelopment or new skills, which the employee has taken the initiative to enrol in, may not even be reimbursed.

To illustrate: If a customer facing employee incurred an expense of Rs.3,600 if he spoke to an outstation customer, but his reimbursement was capped at Rs. 2,000 a month - he stands to lose. Or if an enthusiastic employee has enrolled in an online course to hone his communication skills, he may not even be entitled to a reimbursement. Nor can the employee claim such expense as a deduction while calculating his taxa ble income.

On the other hand, a business person or profes sional can claim as a legitimate business expend iture a plethora of items - in addition to his office rent and staff expenses.These would include commute and travel, customer entertainment expenses, petrol bills and driver's salary, fees paid for various training programs, subscription to business journals...The list can be endless, Expenses claimed as a `bonafide' business deduction, reduce the taxable income of the business person or professional, resulting in a lower Income-tax (I-T) outgo.

To top it all, creativity has no bounds when it comes to making claims for availing a tax deduction. Ironically, some of these claims have been made by legal eagles. However, tax tribunals and courts have frowned on such `out of the box' claims and denied the expenditure that was sought as a deduction.

Standard deduction offers some parity

The reasons are manifold - such as a huge parallel economy, which the government is trying hard to tackle or that agricultural income is tax free in an agrarian dominant society.Contrast this: Super rich farmers don't have to cough up a single paise as tax, while the salaried class bear its full brunt.

Unlike self-employed individuals (be it business persons or professionals), salaried employees only enjoy a few tax free allowances, the quantum of which has clearly not kept pace with inflation.

For instance, a small tax exemption of Rs. 1,600 per month is available for transport allowance paid for commuting to and fro between home and office. For a person residing in Virar (a suburb of Mumbai) who commutes daily to his office in the Nariman Point business district - a first class monthly season ticket plus auto fare from his home to the railway station works upwards of Rs. 2,500.

While tax free limits for allowances which can be availed of by salaried employees are fixed by the government, salaried employees face another hurdle when it comes to reimbursement of claims.Most companies impose caps for reimbursement of expenses. Or some expenses, such as training for selfdevelopment or new skills, which the employee has taken the initiative to enrol in, may not even be reimbursed.

To illustrate: If a customer facing employee incurred an expense of Rs.3,600 if he spoke to an outstation customer, but his reimbursement was capped at Rs. 2,000 a month - he stands to lose. Or if an enthusiastic employee has enrolled in an online course to hone his communication skills, he may not even be entitled to a reimbursement. Nor can the employee claim such expense as a deduction while calculating his taxa ble income.

On the other hand, a business person or profes sional can claim as a legitimate business expend iture a plethora of items - in addition to his office rent and staff expenses.These would include commute and travel, customer entertainment expenses, petrol bills and driver's salary, fees paid for various training programs, subscription to business journals...The list can be endless, Expenses claimed as a `bonafide' business deduction, reduce the taxable income of the business person or professional, resulting in a lower Income-tax (I-T) outgo.

To top it all, creativity has no bounds when it comes to making claims for availing a tax deduction. Ironically, some of these claims have been made by legal eagles. However, tax tribunals and courts have frowned on such `out of the box' claims and denied the expenditure that was sought as a deduction.

Standard deduction offers some parity

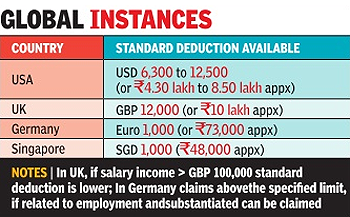

Standard deduction allows for a flat deduction from salary income, to make up for some of the expenses which an employee would typically incur in relation to his employment - be it travel or skill development and offers a degree of parity with a taxpayer who is a business person or professional. Employees in India enjoyed it for a brief period.

In India, it last existed during the financial year 2004-05 and allowed a salaried employee to claim a flat deduction from his or her salary income of 30,000 or 40% of salary (if salary did not exceed 5 Lakhs); or a deduction of 20,000 (if salary exceeded 5 Lakhs).

Creativity has no bounds when it comes to expense claims

1. Heart surgery expense should be allowed, claimed an advocate:

Seasoned advocate Shanti Bhushan claimed bypass surgery expenses as a deduction, on the ground that the heart was a `plant' and the expenditure was in the nature of `current repairs'. He substantiated this argument by showing that his professional income had increased in the years following his 'heart repair'.When this dispute reached the Delhi High Court, the judges light heartedly said: "What is at the heart of the matter, as a matter of fact, is the heart itself."

Turning down the claim made by Bhushan, they pointed out that to claim such expenditure; the heart has to be shown as an asset in the taxpayer's balance sheet at the actual cost of acquisition which would be really difficult to compute.The judges added that a healthy and functional heart is necessary for any human being irrespective of his vocation. It cannot be concluded that the heart is used by, a human being, as a tool of his trade or professional activity. Thus the expense claimed was disallowed.

2. 'Eye-ing' a tax deduction

Dhomant Thakkar, a solicitor claimed foreign tour expenses incurred by him as a deduction from his professional income. This travel related to preoperative investigation of his eyes. The Commissioner of I-T (Appeals) pointed out that such expenditure didn't arise in the course of the solicitor's profession nor was incidental to it. If one were to stretch the logic taken by the taxpayer, then even expenses on food consumed to stay alive, should be allowed, quipped the CIT (Appeals) while rejecting the claim.When this matter reached the Bombay High Court, the judges disallowed the claim."No evidence was brought on record to establish that in the absence of investigation and treatment, the taxpayer would be handicapped in discharging his obligations as a solicitor," states the high court order

3. Charity with benefits

Advocate A.M. Mathur made a donation to a charitable trust with a specific direction that the interest earned from such funds would be utilized solely for purchase of books and periodicals and other library facilities for use by advocates in the Indore High Court. However, he sought to claim the entire donation sum as a deduction from his professional income. For expenditure to be deductible, it must have a nexus with one's business or profession. The Indore bench of the Income-tax Appellate Tribunal turned down this claim, as Mathur was unable to prove what business purpose was served via such donation

The article is contributed by team Ernst & Young

Source:-The Economic Times

0 comments:

Post a Comment