The finance minister has proposed to slash the tax rate for individuals in the lowest income tax slab – Rs 2.5 lakh to Rs 5 lakh –to 5% instead of 10%. The existing rebate under Section 87A (currently given to people with income up to Rs 5 lakh) is proposed to be reduced to Rs 2500 from the existing Rs 5000 for individuals earning between Rs 2.5 lakh to Rs 3.5 lakh.

As a result of the combined effect of the new Section 87A rebate and the reduction in the lowest slab tax rate to 5% the tax burden for those with income upto Rs 3 lakh would be zero and tax burden those in the Rs 3 lakh to Rs 3.5 lakh bracket would be Rs 2500.

Those earning Rs 4.5 lakh can therefore reduce their tax liability to zero by fully utilising the tax break under Section 80C combined with these new proposals.

Those falling in the higher income tax slabs will also be eligible for this lower tax rate of 5% on income between Rs 2.5 lakh and Rs 5 lakh. Therefore, those in the higher tax slabs will pay lower tax by Rs 12500 per person.

Individuals earning between Rs 50 lakh and Rs 1 crore will have to pay a surcharge of 10% on the total income tax payable by them. Currently there was no such surcharge on this category. Only those with income above Rs 1 crore were required to pay surcharge of 15% which continues.

The tax an Indian pays every year is calculated on the basis of his/her gross total income. . The tax is calculated according to the income tax slabs announced by the government every year in the Budget. The annual union budget is normally announced in the month of February.

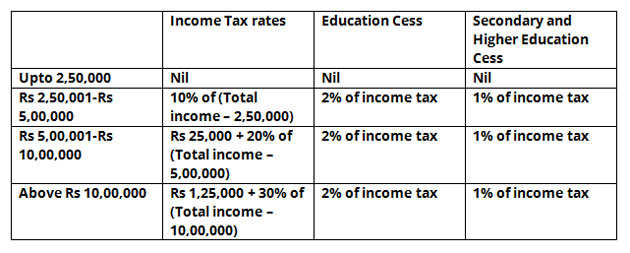

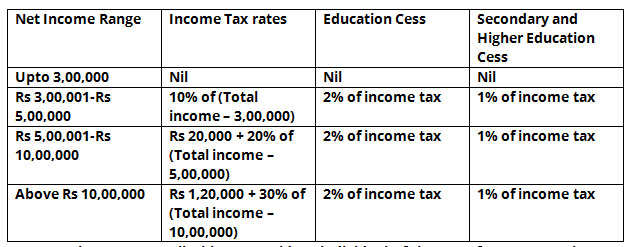

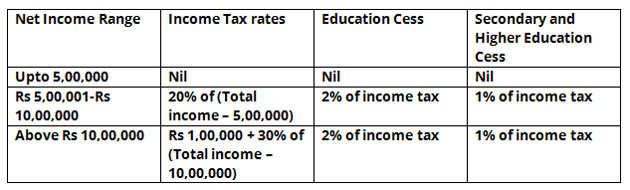

Income tax slab rates for the financial year 2016-17 (assessment year 2017-18) are given below in the table:

1. Normal tax rates applicable to a resident individual below the age of 60 years, non-resident individual, resident/non-resident HUF, AOP, BOI, artificial juridical person.

2. Normal tax rates applicable to a resident individual of the age of 60 years or above at any time during the year but below the age of 80 years

3. Normal tax rates applicable to a resident individual of the age of 80 years or above at any time during the year

After taking the deductions under Section 80 (C) to 80 (U), the tax is payable after adding the cess and surcharge, if applicable.

The education cess of 2% and secondary cess of 1% are calculated on the amount of tax payable separately. Both the cess are then added to the tax payable to arrive at the Gross tax payable amount.

The surcharge is levied @ 15% on the amount of income tax where net income exceeds Rs 1 crore. In the case where the surcharge is levied, the cess will be levied on the tax amount plus surcharge.

A resident individual can also avail rebate under Section 87(A) whose net income is equal to or less than Rs 5 lakh. The amount of rebate under this section is 100% of the income tax or Rs 5,000 whichever is less. It is deductible before calculating the cess.

Source:-The Economic Times

No comments:

Post a Comment