Pages

Tuesday, January 31, 2017

MINUTES OF THE MEETING HELD UNDER THE CHAIRMANSHIP OF SECRETARY, DOP&T ON 23.01.2017

GDS compassionate cases - CRC minutes

Good news! RBI may lift weekly cash withdrawal limit by February end

With cash situation improving, there will be little need to have withdrawal restrictions: Bankers

Manual Attendance may be Discontinued Immediately – PCDA Circular

“As per extant instructions, half-a-day’s casual leave should be debited for each day of late attendance, but late attendance upto an hour, on not more than two occasions in a month, and for justifiable reasons may be condoned by the competent authority.”

Instructions on EOD Process in DOP Finacle

Labour migration in India increasing at an accelerating rate, reveals new study: Economic Survey 2016-17

Government of India

Ministry of Finance

31-January-2017 12:55 IST

Labour migration in India increasing at an accelerating rate, reveals new study: Economic Survey 2016-17

New estimates of labour migration in India have revealed that inter-state labor mobility is significantly higher than previous estimates. This was stated in the Economic Survey 2016-17 presented by the Finance Minister Shri Arun Jaitley in the Parliament today. The study based on the analyses of new data sources and new methodologies also shows that the migration is accelerating and was particularly pronounced for females. The data sources used for the study are the 2011 Census and railway passenger traffic flows of the Ministry of Railways and new methodologies including the Cohort-based Migration Metric (CMM) .

The new Cohort-based Migration Metric(CMM) shows that inter-state labor mobility averaged 5-6.5 million people between 2001 and 2011, yielding an inter-state migrant population of about 60 million and an inter-district migration as high as 80 million. The first-ever estimates of internal work-related migration using railways data for the period 2011-2016 indicate an annual average flow of close to 9 million migrant people between the states. Both these estimates are significantly greater than the annual average flow of about 4 million suggested by successive Censuses and higher than previously estimated by any study.

Figure 1. Estimates of annual migrant flows based on railway traffic data

The second finding from this new study is that migration for work and education is accelerating. In the period 2001-2011 the rate of growth of labour migrants nearly doubled relative to the previous decade, rising to 4.5 per cent per annum. Interestingly, the acceleration of migration was particularly pronounced for females and increased at nearly twice the rate of male migration in the 2000s. There is also a doubling of the stock of inter-state out migrants to nearly 12 million in the 20-29year old cohort alone. One plausible hypothesis for this acceleration in migration is that the rewards (in the form of prospective income and employment opportunities) have become greater than the costs and risks that migration entails. Higher growth and a multitude of economic opportunities could therefore have been the catalyst for such an acceleration of migration.

Third, and a potentially exciting finding, for which there is tentative but no conclusive evidence, is that while political borders impede the flow of people, language does not seem to be a demonstrable barrier to the flow of people. For example, a gravity model indicates that political borders depress the flows of people, reflected in the fact that migrant people flows within states are 4 times than migrant people flows across states. However, not sharing Hindi as a common language appears not to create comparable frictions to the movement of goods and people across states.

Fourth, the patterns of flows of migrants found in this study are broadly consistent with what is expected - less affluent states see more out migration migrating out while the most affluent states are the largest recipients of migrants. Figure 2 shows the strong positive relationship between the CMM scores and per capita incomes at the state level. Relatively poorer states such as Bihar and Uttar Pradesh have high net out-migration. Seven states take positive CMM values reflecting net in-migration: Goa, Delhi, Maharashtra, Gujarat, Tamil Nadu, Kerala and Karnataka. Fifth, the costs of moving for migrants are about twice as much as they are for goods – another confirmation of popular conception.

Figure 2. Cohort-based Migration Metric vs. Real Incomes across States

Policy actions to sustain and maximize the benefits of migration include: ensuring portability of food security benefits, providing healthcare and a basic social security framework for migrants – potentially through an inter-state self-registration process. While there do currently exist multiple schemes that have to do with migrant welfare, they are implemented at the state level, and hence require greater inter-state coordination.

******

India Post Payments Bank will be a game changer for financial inclusion-Manoj Sinha

Press Information Bureau

Government of India

Ministry of Communications & Information Technology

30-January-2017 18:27 IST

India Post Payments Bank will be a game changer for financial inclusion-Manoj Sinha

IPPB branches launched in Ranchi & Raipur

Finance Minister, Shri Arun Jaitley and Minister of Communications Shri Manoj Sinha launched the operations of the India Post Payments Bank (IPPB) here today as two pilot branches at Raipur and Ranchi through video conferencing from Delhi.

Speaking on the occasion, Shri Jaitley said that about 650 IPPB branches will be opened by September this year and that will have a multiplier impact as far as banking in India is concerned. He said with IPPB, banking at the doorstep will no longer remain a mere slogan, but will become a reality due to huge postal network in the country. He said that financial Inclusion is critical for the socio-economic development of the country, but there are significant gaps in this area and a large proportion of country’s population remain unbanked or underbanked. IPPB will effectively leverage the ubiquitous post office network with its pan-India physical presence, long experience in cash handling and savings mobilization, backed by the ongoing project of IT-enablement, to bridge this gap in Financial Inclusion.

In his address, Minister of Communications Shri Manoj Sinha has commended the hard work done by the Department of Posts in setting up the India Post Payments Bank and hoped that both organizations will work in tandem to take the benefits of government schemes and financial services that are not easily available in rural areas to customers across the country and to the marginalized population in urban and rural areas alike. He said, the objective of IPPB will be public service rather than promoting commercial interests.

Secretary, Department of Posts, Shri B.V.Sudhakar said that the IPPB is widely expected to be a game changer for financial inclusion in the country as the USP of this initiative is doorstep banking, particularly in the rural areas.

As mandated by the RBI, the India Post Payments Bank (IPPB) would focus on providing basic financial services such as all kinds of payments; including social security payments, utility bill payments, person to person remittances (both domestic and cross-border), current and savings accounts up to a balance of Rs 1 lac, distribution of insurance, mutual funds, pension products and acting as business correspondent to other banks for credit products especially in rural areas and among the underserved segments of the society.

Set up us a 100% Government of India owned Public Limited Company under the Department of Posts, it will open around 650 branches in district HQ locations. All 1.55 lacs post offices including the 1.39 lac of the rural post offices will be mapped to the IPPB branch at the district headquarter and function as access points for IPPB. IPPB will usher in state of the art internet and mobile banking platforms, digital wallets and use innovative and emerging technologies to catalyse the shift from a cash dominant to a less cash economy.

While many other banks and financial institutions are working on the same theme, the USP of IPPB will be its ability to ease access and handhold the adoption of new age banking and payments instruments among citizen of all walks of life through the delivery by postmen and Grameen Dak sevaks, savings agents and other franchisees who will take banking to door steps. IPPB thus aspires to the most accessible, affordable and trusted bank for the common man with the motto - “No customer is too small, no transaction too insignificant, and no deposit too little”.

Given ‘in principle’ approval by the RBI along with 10 other aspirants on 19th Aug 2015, IPPB received the cabinet’s approval on 1st June, 2016 and was incorporated as on 17th Sept, 2106. Today it became the second payments bank to launch its operations. Having got its final banking license from the RBI on the 20th Jan 2017 it has commenced operations in record time of 10 days in partnership with the Punjab National Bank, after obtaining all necessary approvals and registrations from the RBI, NPCI etc.

A commemorative stamp and a logo of the new bank were also launched on the occasion.

Why humanity remember Gandhi

Press Information Bureau

Government of India

Special Service and Features

27-January-2017 13:01 IST

Why humanity remember Gandhi

In the world of thorough compartmentalization dictated by industrialized division of labour in which humanity find itself having lost the sense of purpose and identity, Gandhi showed a holistic way that leads us into experiencing life in its fullness.

*Dr. D John Chelladurai

He got this holistic perspective from the realization of Truth as God, which is eternal, an all encompassing reality. ‘Being part of the whole’, he acknowledged, ‘I too am a part of the Truth’. In the epistemological sense it reflects the wisdom of Upanishad ‘Aham Brahmasmi’.

Functionally, his pursuit of Truth could be termed as an advaita (non-dualistic) practice. He saw a singular Truth in umpteen facets of life. Ekam Sat vipra Bahudha vadanti. For him, each of his efforts was some part of the truth or his endless quest for it. Even the means of his striving, nonviolence, according to him, was a form of Truth. Truth is God and Nonviolence the religion, he explained. Johan Galtung put it as ‘the way is the goal’.

This led him into a unique experience of an inclusive method, a comprehensive approach to life. He saw oneness in all and everything. That is how he could declare “I have no enemy” even while fighting against British imperialism. He then clarified, ‘my fight is against the wrong and not the wrong doer who is my brother’.

This perspective of endearing oneness is evident in all his endeavors right from his early years.

Be it his colleagues in South Africa, men and women from wide range of persuasions: Muslims, Parsis, Christians, Jews, north Indians and South Indians in equal measure; or his fellow satyagrahis as diverse as the mighty Pathans from the north-west frontier and the meekly peasants of Bihar; or is readiness to induct into his domestic fold Dalits and Leprosy Patients with equal elan, or his prayers that integrated the spirit of all religions, he led humans into a new social reality.

His non-dualistic vision helped him lay the conceptual foundation for a new nation. He interpreted ‘Purna Swaraj’ which originally meant as ‘complete freedom from the bonds of the British’,into a principle of liberation from all evils – of both what are within individual – value decay and lack of social sensibility, and between individuals – socio, economic political injustice and inequalities. His 18 constructive programs represent as many facets of liberation: freedom from alcoholism, communal enmity, poverty, sanitation problem, gender inequality so on.

Ideologically he harmonized Satya and Ahimsa as two sides of a coin; and functionally Satyagraha (struggle against the imperial power) and Constructive interventions (building a society of empowered masses) as two wings of a flight to freedom.

Civilization would however remember Gandhi for the all encompassing way of living he professed for the divided world. The guiding spirit is Truth. That enabled him to cultivate within him a triune dexterity called harmony between word, thought and deed; head heart and hand; and between ‘oneself, fellow beings and God.

His non-dualistic (seeing one in all) methodology led him further into a process of social amalgamation, and helped him see potential for human betterment in the same traits that divided humanity into water tight compartments. For instance, he could see the productive craftsmanship of the shudras, the material acumen of the Bania, the righteous indignation of the Kshatriya and the sagely scholarship of Brahmin are adorable human qualities equally important to every modern human.

And thus, he was happy being a shudra when needed to cultivate his grains, spinning out his own clothes and building hutments in the ashram; he was a typical bania (vaishya) while bargaining for freedom and mobilizing resources for it; as a satyagrahi he showed the valor of a Kshatriya fighting against the antagonistic powers for the sake of humanity even at the risk of his own life. As a seeker after truth he spoke with the clarity of a Brahmin (scholar and teacher). Thus he brought down the walls that stood between the classes and sailed from one class to another seamlessly.

Similarly, he translated the four stages of life (Ashramas) into four noble virtues to be adopted, not one after another, but all the time together. While being a grahastha (ashram being his large joint family), he was a brahmacharya all along; without retiring into Jungle he attained liberation. While living in the thick of the society, he informed, he carries a potable ‘cave’ (society) for spiritual contemplation every moment.

The same harmonizing perspective helped Gandhi braid the four yogic paths into one noble passage for holistic realization. His passion for Truth and Nonviolence that “transcended human reasoning” was the height of bhakti, equivalent to that of Mira, that fired him to be an invincible adherent of Truth. Be it his Khadi movement, Harijan campaign or striving for communal harmony, we see an unstoppable performer and his performance evinced the quality of a karma yogi. His conscious exploration into the inner recesses of Truth gave him the wisdom of a gyan yogi; empowered by the bhakti and gyan, his karma (action) invariably steered him to lead the masses out of man-made suffering. The making of the ‘father of the nation’ is certainly one of Raja Yoga.

Thus Gandhi in his advaita realization of Truth, saw life as a comprehensive experience, not to be realized in compartments, but all inclusively. The realization of oneness enabled him to see the worth of multifarious manifestations without deterred by their diversity, helped him sail between classes of society, phases of life and through diverse paths of life and ethical schools.

In the world of thorough compartmentalization dictated by industrialized division of labour in which humanity find itself having lost individual sense of purpose and identity, Gandhi shows in this manner, a holistic way to realize the fullness of life. Civilization would remember him for this forever.

******

**An alumni of Gujarat Vidyapeeth, Dr D John Chelladurai is currently the Dean, of Gandhi Research Foundation, Jalgaon, (Maharashtra), He is a social analyst and specializes in ‘Conflict Transformation’ and ‘Peace Building’.

"The Views expressed in the Article are his personal."

Com. R C Mishra, Ex-Circle Secretary, AIPEU, Group-C, Odisha Circle retires from Govt. service

Our beloved Ex-Circle Secretary Com. Ramesh Chandra Mishra under whose able leadership we have been protected for last 13 years retires today, i.e.31.01.2017 on attaining the age of superannuation as O A, Postal Stores Depot, Bhubaneswar.

After successful performance for 8 years as the Divisional Secretary, AIPEU, Group-C, Bhubaneswar Division, it was the year 2003 when this vast platform got Com. R C Mishra as its Circle Secretary. Prior to that, the position of Odisha Circle was very negligible in comparison to all India performances and participations. After Com. Mishra took the responsibility, Odisha Circle became an eye-catcher remaining always in 2nd or 3rd position for its trade union organizational activities.

Apart from the Circle Secretary, he has also discharged his responsibilities successfully as the Chairman, NFOE, Odisha Circle, Leader, RJCM, Odisha Circle and Vice-President, Confederation of Central Govt. Employees and Workers, Odisha State CoC. His contribution to AIPEU, Group-C, NFPE and Confederation will be ever remembered.

On this day of 31st January, 2017, when Com. Mishra is retiring from Govt. Service, AIPEU, Group-C, Dhenkanal Division wishes him a very happy and healthy retired life.

Income Tax Department (ITD) launches Operation Clean Money

Press Information Bureau

Government of India

Ministry of Finance

31-January-2017 16:31 IST

Income Tax Department (ITD) launches Operation Clean Money

Income Tax Department (ITD) has initiated Operation Clean Money, today. Initial phase of the operation involves e-verification of large cash deposits made during 9th November to 30th December 2016. Data analytics has been used for comparing the demonetisation data with information in ITD databases. In the first batch, around 18 lakh persons have been identified in whose case, cash transactions do not appear to be in line with the tax payer’s profile.

ITD has enabled online verification of these transactions to reduce compliance cost for the taxpayers while optimising its resources. The information in respect of these cases is being made available in the e-filing window of the PAN holder (after log in) at the portal https://incometaxindiaefiling.gov.in. The PAN holder can view the information using the link “Cash Transactions 2016” under “Compliance” section of the portal. The taxpayer will be able to submit online explanation without any need to visit Income Tax office.

Email and SMS will also be sent to the taxpayers for submitting online response on the e-filing portal. Taxpayers who are not yet registered on the e-filing portal (at https://incometaxindiaefiling.gov.in) should register by clicking on the ‘Register Yourself’ link. Registered taxpayers should verify and update their email address and mobile number on the e-filing portal to receive electronic communication.

A detailed user guide and quick reference guide is available on the portal to assist the taxpayer in submitting online response. In case of any difficulty in submitting on line response, help desk at 1800 4250 0025 may be contacted.

Data analytics will be used to select cases for verification, based on approved risk criteria. If the case is selected for verification, request for additional information and its response will also be communicated electronically. The information on the online portal will be dynamic getting updated on receipt of new information, response and data analytics.

The response of taxpayer will be assessed against available information. In case explanation of source of cash is found justified, the verification will be closed without any need to visit Income Tax Office. The verification will also be closed if the cash deposit is declared under Pradhan Mantri Garib Kalyan Yojna (PMGKY).

The taxpayers covered in this phase should submit their response on the portal within 10 days in order to avoid any notice from the ITD and enforcement actions under the Income-tax Act as also other applicable laws

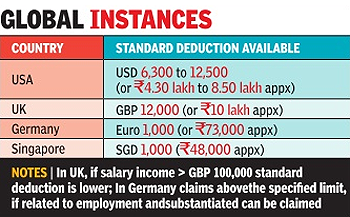

Union Budget 2017: Why salaried class deserves standard deduction

The reasons are manifold - such as a huge parallel economy, which the government is trying hard to tackle or that agricultural income is tax free in an agrarian dominant society.Contrast this: Super rich farmers don't have to cough up a single paise as tax, while the salaried class bear its full brunt.

Unlike self-employed individuals (be it business persons or professionals), salaried employees only enjoy a few tax free allowances, the quantum of which has clearly not kept pace with inflation.

For instance, a small tax exemption of Rs. 1,600 per month is available for transport allowance paid for commuting to and fro between home and office. For a person residing in Virar (a suburb of Mumbai) who commutes daily to his office in the Nariman Point business district - a first class monthly season ticket plus auto fare from his home to the railway station works upwards of Rs. 2,500.

While tax free limits for allowances which can be availed of by salaried employees are fixed by the government, salaried employees face another hurdle when it comes to reimbursement of claims.Most companies impose caps for reimbursement of expenses. Or some expenses, such as training for selfdevelopment or new skills, which the employee has taken the initiative to enrol in, may not even be reimbursed.

To illustrate: If a customer facing employee incurred an expense of Rs.3,600 if he spoke to an outstation customer, but his reimbursement was capped at Rs. 2,000 a month - he stands to lose. Or if an enthusiastic employee has enrolled in an online course to hone his communication skills, he may not even be entitled to a reimbursement. Nor can the employee claim such expense as a deduction while calculating his taxa ble income.

On the other hand, a business person or profes sional can claim as a legitimate business expend iture a plethora of items - in addition to his office rent and staff expenses.These would include commute and travel, customer entertainment expenses, petrol bills and driver's salary, fees paid for various training programs, subscription to business journals...The list can be endless, Expenses claimed as a `bonafide' business deduction, reduce the taxable income of the business person or professional, resulting in a lower Income-tax (I-T) outgo.

To top it all, creativity has no bounds when it comes to making claims for availing a tax deduction. Ironically, some of these claims have been made by legal eagles. However, tax tribunals and courts have frowned on such `out of the box' claims and denied the expenditure that was sought as a deduction.

Standard deduction offers some parity

Standard deduction allows for a flat deduction from salary income, to make up for some of the expenses which an employee would typically incur in relation to his employment - be it travel or skill development and offers a degree of parity with a taxpayer who is a business person or professional. Employees in India enjoyed it for a brief period.

In India, it last existed during the financial year 2004-05 and allowed a salaried employee to claim a flat deduction from his or her salary income of 30,000 or 40% of salary (if salary did not exceed 5 Lakhs); or a deduction of 20,000 (if salary exceeded 5 Lakhs).

Creativity has no bounds when it comes to expense claims

1. Heart surgery expense should be allowed, claimed an advocate:

Seasoned advocate Shanti Bhushan claimed bypass surgery expenses as a deduction, on the ground that the heart was a `plant' and the expenditure was in the nature of `current repairs'. He substantiated this argument by showing that his professional income had increased in the years following his 'heart repair'.When this dispute reached the Delhi High Court, the judges light heartedly said: "What is at the heart of the matter, as a matter of fact, is the heart itself."

Turning down the claim made by Bhushan, they pointed out that to claim such expenditure; the heart has to be shown as an asset in the taxpayer's balance sheet at the actual cost of acquisition which would be really difficult to compute.The judges added that a healthy and functional heart is necessary for any human being irrespective of his vocation. It cannot be concluded that the heart is used by, a human being, as a tool of his trade or professional activity. Thus the expense claimed was disallowed.

2. 'Eye-ing' a tax deduction

Dhomant Thakkar, a solicitor claimed foreign tour expenses incurred by him as a deduction from his professional income. This travel related to preoperative investigation of his eyes. The Commissioner of I-T (Appeals) pointed out that such expenditure didn't arise in the course of the solicitor's profession nor was incidental to it. If one were to stretch the logic taken by the taxpayer, then even expenses on food consumed to stay alive, should be allowed, quipped the CIT (Appeals) while rejecting the claim.When this matter reached the Bombay High Court, the judges disallowed the claim."No evidence was brought on record to establish that in the absence of investigation and treatment, the taxpayer would be handicapped in discharging his obligations as a solicitor," states the high court order

3. Charity with benefits

Advocate A.M. Mathur made a donation to a charitable trust with a specific direction that the interest earned from such funds would be utilized solely for purchase of books and periodicals and other library facilities for use by advocates in the Indore High Court. However, he sought to claim the entire donation sum as a deduction from his professional income. For expenditure to be deductible, it must have a nexus with one's business or profession. The Indore bench of the Income-tax Appellate Tribunal turned down this claim, as Mathur was unable to prove what business purpose was served via such donation

The article is contributed by team Ernst & Young

Payments banks to have multiplier impact on system: FM Arun Jaitley

Launching pilot services of India Post Payments Bank (IPPB) at Raipur and Ranchi on Monday, Jaitley said IPPB will expand operations to 650 districts by September. India Post, which got the permit to launch banking operations on January 20, is only the third entity to have received central bank's approval to start operations, after Airtel Payments Bank and Paytm.

"The pattern in which the payments bank is being formed, the overhead cost is very less because the existing structure is being used. Going forward, a time will come when for small depositors, this payments bank will give competition to normal banking," Jaitley said.

He said telecom companies have lakhs of stores which will start working as payments banks. Also with 1.55 lakh post office branches and the services of lakhs of postmen being converted into banking operations with the launch of India Post Payments Bank, the demand for a brick and mortar bank branches in far flung villages will get reduced.

Payments banks can accept deposits of up to Rs 1lakh per account from individuals and small businesses. The new model of banking allows mobile firms, supermarket chains and others to cater to banking requirements of individuals and small businesses. The new banks will confine activities to acceptance of deposits, remittance services, Internet banking and other specified services.

RBI removes withdrawal limits on current accounts

Reserve Bank of India (RBI) removed the limits on withdrawals from current accounts, but kept the overall limit at Rs 24,000 a week for savings bank account.

In a notification, the central bank said it was doing away with the Rs 1 lakh per week limit on current accounts even as it suggested that banks can keep their own limits for these accounts.

"Limits...placed on cash withdrawals from ATMs stand withdrawn from February 01, 2017. However, banks may, at their discretion, have their own operating limits as was the case before November 8, 2016," RBI said.

The limits on bank withdrawals were placed after the withdrawal of Rs 500 and Rs 1000 notes announced on November 8. Currency was in short supply after the withdrawal as the newly designed notes took time to come into circulation.

The limit on weekly withdrawals from current account was raised to Rs 1 lakh earlier this month from the Rs 50,000 set just after the November 8 announcement.

RBI said that the Rs 24,000 limit on withdrawals from savings accounts per week could also be relooked. "The limits on savings bank accounts will continue for the present and are under consideration for withdrawal in the near future. Further, banks are urged to encourage their constituents to sustain the movement towards digitisation of payments and switching over of payments from cash mode to non-cash mode," RBI said.

Source:-The Economic Times